Residential takes the reins as contract awards even out

- Awards see slight fall on the previous month but the residential sector bounces back from poor February.

- A continued positive trend in contract awards in Q1 suggests the sector is looking to emerge from doldrums of 2023.

- Lack of new applications suggests the crossroads have not yet been passed.

Construction contract rewards remained stable in March following a quarter which had showed a significant increase since the beginning of the year. The value of new contracts was 3% down in February and 1% down on the previous year but remained significantly above the last quarter of 2023, according to analysis from Barbour ABI.

Notably, residential contracts were up 60% in February, returning to heights seen in January and were up 62% over the first quarter of the year. Meanwhile, infrastructure fell back to more normal levels following a stellar February but remained 38% up on the same month last year.

A new student accommodation facility on Medlock Steet, Manchester will cost £200 million, whilst a new National Grid convertor station at Eastern Green will be built at a cost of £700 million. A new prison at HMP Gartree was also awarded at a cost of £300million. Wates will carry out the work which will commence July 2024.

Barbour ABI head of business and client analytics, Ed Griffiths commented:

“When looking across the first quarter of 2024 it has become clear that both the infrastructure and residential sectors have had strong starts to the year as businesses attempt to get projects off the ground, which is a positive signal the construction sector is attempting to emerge from the doldrums of last year.

“Interestingly in March, we saw Residential and Infrastructure swapping positions in terms of leading overall contract awards value with £2.4bn and £2bn respectively. Together they are pushing the industry awards upwards.”

Elsewhere Healthcare projects were subdued in March following two strong months and Economic conditions continue to stagnate the Hotel and Leisure Sector

[edit] Applications continue to confound recovery.

Planning applications have improved in February after a weak start to the year in January but activity levels in most sectors remain low, highlighting that nervousness remains in the sector to commit to future projects ahead of potential rates cuts and upcoming elections.

Infrastructure has increased 33% since last month and remains strong against its long-term average. However, it has not returned to the highs of the end of last year. Residential applications fell once again from £3.1bn in January to £2.9bn in February.

Griffiths continued: “The enduring story of 2024 so far has been the contradiction between a rise in contracts awarded, sometimes even for projects which have not yet been fully approved, and the continued lack of confidence shown in both in new applications and approvals - which have been contracting since last November. The industry stands at a crossroads where financial and political decisions made at a national level could tip the balance in either direction.”

Find out more at https://barbour-abi.com/

--Barbour ABI 09:43, 12 Apr 2024 (BST)

[edit] Related articles on Designing Buildings

- 2023 Spring Budget summary and industry response

- April turn for the worse, for construction, as market seesawing continues.

- Construction knowledge sources

- Construction industry statistics.

- Construction industry reports.

- Construction industry revs engines in January

- Infrastructure tumbles, adding to construction industry woes

- New energy rules, a threat to towns and cities across UK

- Planning Portal partnership boosts industry access to planning information.

- Risk management.

- Subdued planning environment figures provide scant hope for house-building targets

- UK Construction saw an £11.1bn fall in spending in 2023

Featured articles and news

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

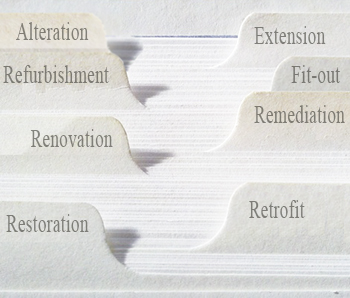

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.